A couple of weeks in the past I wrote How Protected is an 8% Withdrawal Fee? in line with some remarks made through Dave Ramsey. In reaction, a handful of other folks reached out asking: What would those retirement effects appear to be with a different portfolio as an alternative of a 100% inventory one? Due to this fact, I ran the numbers to determine.

However, prior to we get to those effects, I wish to take a second to discover the elemental idea that underpins maximum retirement making plans—the protected withdrawal charge (“SWR”). Now not simplest will I outline what the SWR is and the place it all started, however I will be able to read about the ancient result of the usage of it, some dangers and criticisms of the method, and different choice spending methods you’ll use right through your golden years.

Let’s start.

What’s the Protected Withdrawal Fee (SWR) and The place Did it Start?

In terms of making plans for retirement, the most important monetary fear is typically: will I run out of cash? That is the place the protected withdrawal charge can be in agreement. The protected withdrawal charge is the share of your retirement financial savings that you’ll withdraw each and every yr (adjusting every year for inflation) with out operating out of cash in retirement.

The protected withdrawal charge may also be traced again to investigate accomplished within the early Nineties through William Bengen. As I said in Simply Stay Purchasing:

Bengen discovered that retirees right through historical past can have withdrawn 4% of a 50/50 (inventory/bond) portfolio every year for a minimum of 30 years with out operating out of cash. This used to be true even supposing the withdrawal quantity grew through 3% each and every yr to stay alongside of inflation.

Due to this fact, if anyone had a $1 million funding portfolio, they might were in a position to withdraw $40,000 of their first yr, $41,200 of their 2d yr, and so on for a minimum of 30 years prior to operating out of cash. If truth be told, operating out of cash whilst the usage of the 4% rule has been traditionally not likely. When professional monetary planner Michael Kitces did an research of the 4% rule going again to 1870, he discovered that it, “quintupled wealth extra regularly than depleting major after 30 years.”

Bengen’s concept used to be additional validated and popularized with the discharge of The Trinity Learn about in 1998. This find out about, which used to be authored through 3 finance professors at Trinity College, analyzed ancient go back information to check the feasibility of more than a few withdrawal charges. Very similar to Bengen, the find out about concluded:

If historical past is any information for the long run, then withdrawal charges of three% and four% are extraordinarily not likely to exhaust any portfolio of shares and bonds right through any of the payout sessions…

And, similar to that, the protected withdrawal charge and the 4% rule have been born. Since then, 4% has been the protected withdrawal charge and guiding monetary knowledge that has been handed all the way down to each and every cohort of recent retirees. However, this begs the query: what’s the protected withdrawal charge nowadays? For this, we flip to our subsequent phase.

What’s the Protected Withdrawal Fee Lately?

Whilst we will be able to by no means know what the protected withdrawal charge shall be at some point, we will be able to resolve for what the protected withdrawal charge has been previously. With this in thoughts, I examined withdrawal charges starting from 4% to ten% on portfolios starting from 50% U.S. shares/50% U.S. bonds to 100% U.S. shares/0% U.S. bonds. Total, the effects led me to 3 conclusions:

- In spite of having extra ancient information (thru 2022), the protected withdrawal charge remains to be 4%.

- If you’ll get through with a decrease withdrawal charge (<6%), you portfolio must personal a tight quantity of U.S. bonds (30%-40%).

- If you happen to require a upper withdrawal charge (>=6%), then you definitely must allocate extra to U.S. shares (80%+), which can lower the risk that you simply run out of cash in retirement.

- Notice: Requiring a better withdrawal charge is riskier in that you’re much more likely to expire of cash in retirement. Alternatively, should you should withdraw extra, then it’s in fact much less dangerous to put money into belongings with upper anticipated returns (i.e. shares over bonds). Why? As a result of this extra enlargement is the one probability you might have of no longer operating out of cash with any such excessive withdrawal charge.

Whilst those effects would possibly appear at odds with each and every different, they in fact aren’t. Since U.S. shares have had many sessions of excessive enlargement and a couple of uncommon sessions of low/unfavorable enlargement, they have a tendency to be your best choice for many of your portfolio as a rule. Let’s have a look at some effects as an instance this.

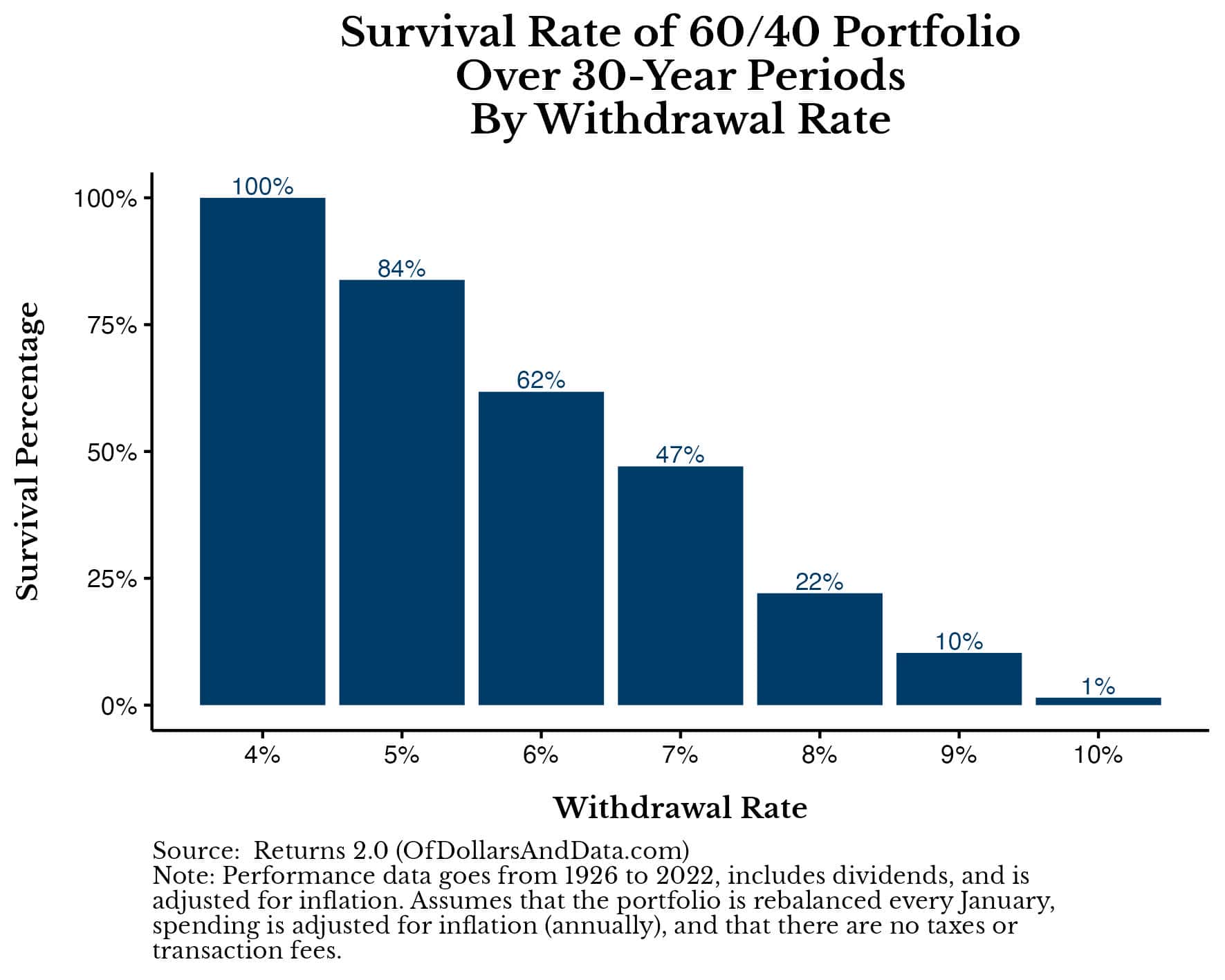

To begin, we will be able to read about how a 60/40 portfolio carried out with more than a few withdrawal charges throughout each 30-year duration from 1926 to 2022 (68 complete sessions in overall):

As you’ll see, whilst this portfolio does neatly with a 4% withdrawal charge (surviving 100% of all 30-year simulations), as you building up the withdrawal charge, the speed of failure additionally will increase. As a reminder, in the entire simulations I ran your spending is ready on the very starting of the simulation (Yr 1) after which adjusted every year through inflation each and every yr for the following 30 years.

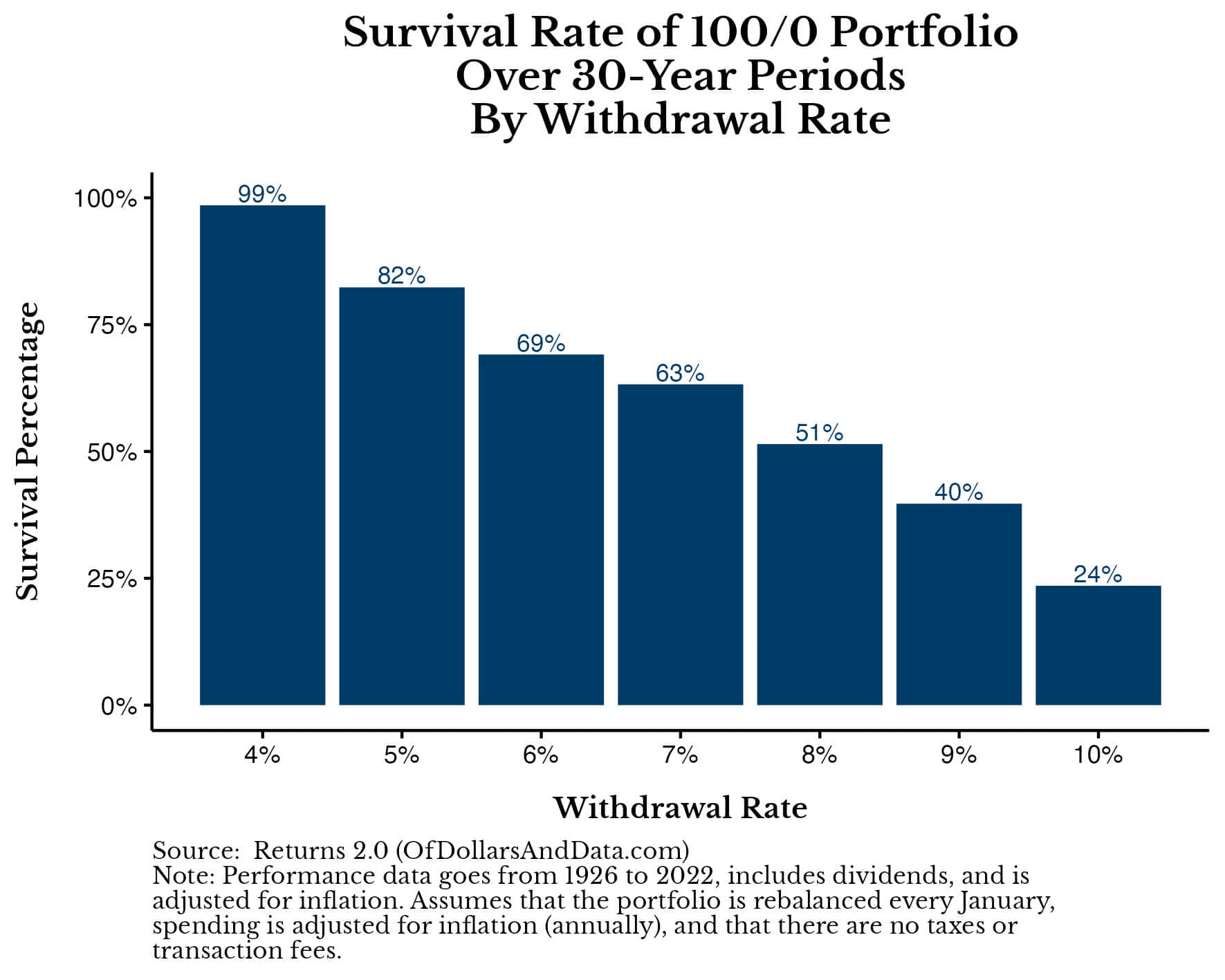

We will be able to evaluate this to the usage of a 100/0 (“All Inventory”) portfolio and notice that the All Inventory portfolio plays a lot better at upper withdrawal charges:

Now, with a 100% U.S. inventory portfolio, your probability of survival with an 8% withdrawal charge would’ve been more than 50% in comparison to simplest 22% for a 60/40 portfolio. It’s because those 51% of simulations all correspond with ancient sessions the place U.S. shares had fantastic enlargement with out deep, prolonged downturns. Total, those means that, while you should withdraw extra, you wish to have to take extra possibility to deal with this upper want out of your portfolio.

However as an alternative of simply inspecting those leads to a vacuum, I’ve additionally created a GIF that cycles thru those effects (from a 50/50 portfolio to a 100/0 portfolio) so you’ll evaluate them visually extra simply:

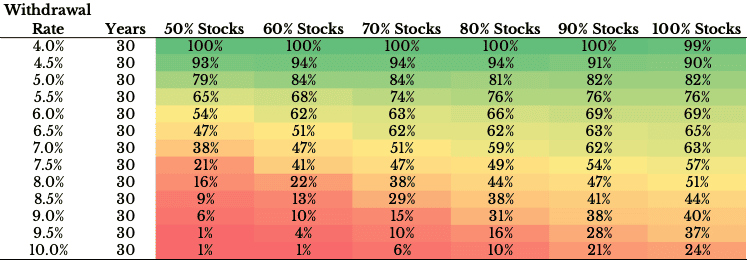

This makes it more straightforward to peer how a lot of a receive advantages you get through depending on a better inventory allocation when requiring a better withdrawal charge. As well as, I additionally created a heatmap of those effects the place you’ll evaluate all of those portfolios and their survival possibilities without delay (for more than a few withdrawal charges):

The fairway phase around the most sensible represents the protected withdrawal charge, the place you could no longer have run out of cash in just about all ancient sessions. However as you progress down the desk (through expanding your withdrawal charge), the effects grow to be increasingly more worse as you grow to be much more likely to expire of cash.

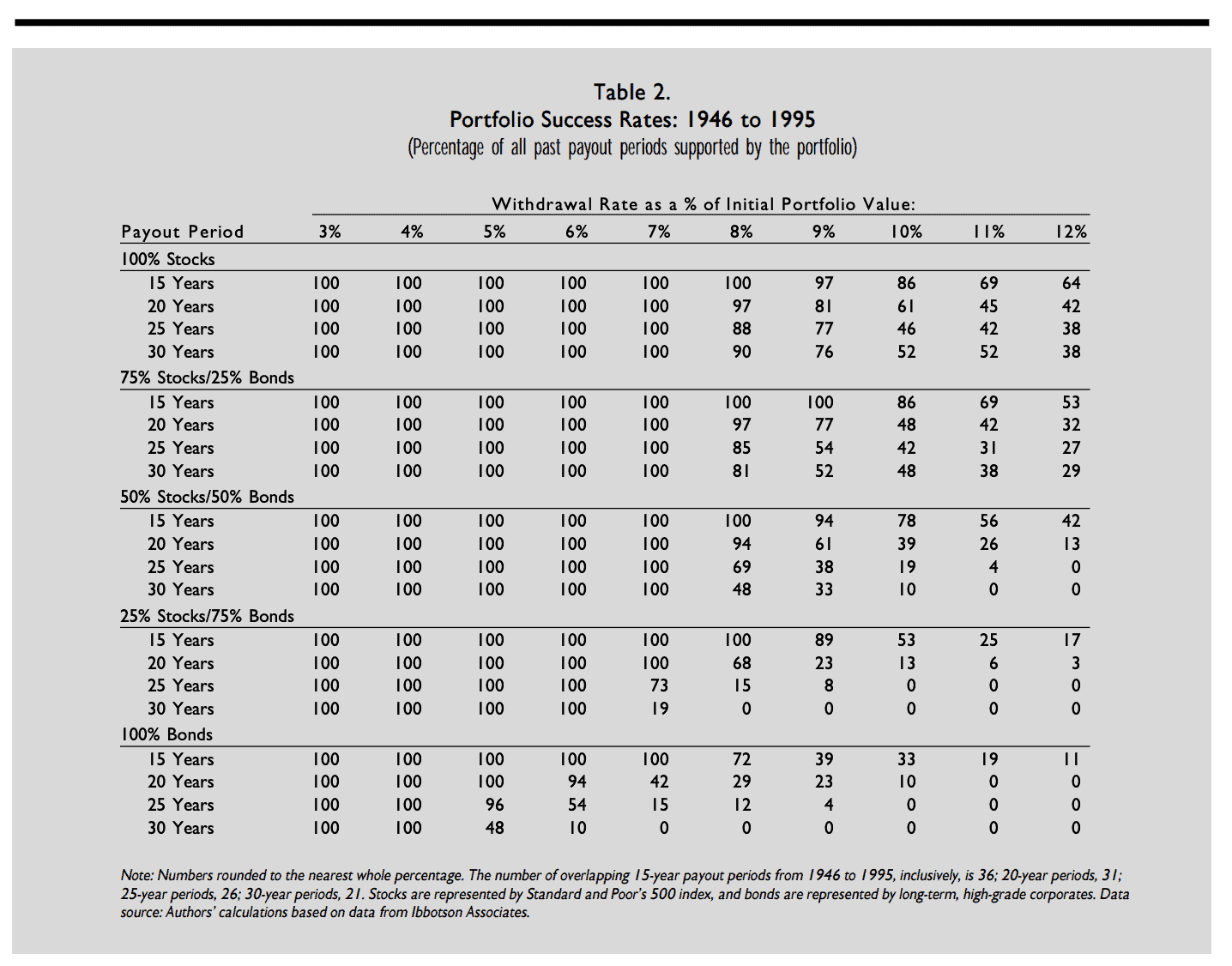

Notice that my effects above are just a little worse (and extra life like) than those introduced within the Trinity Learn about, which trusted information simplest from 1946-1995:

Through except the Nice Despair (Nineteen Thirties) and no longer but having the DotCom bubble (2000-2003) nor the Nice Monetary Disaster (2008-2009), the Trinity Learn about paints a rosier image of the protected withdrawal charge than what historical past in fact suggests.

Nonetheless, from my effects introduced above, we will be able to infer that:

- 4% remains to be the protected withdrawal charge, and

- If you happen to require a better withdrawal charge (e.g. 6% or extra), then you will have extra excessive enlargement belongings (e.g. shares) to your portfolio.

Now that we’ve appeared on the effects for more than a few withdrawal charges and portfolios, let’s speak about one of the vital dangers and criticisms of the protected withdrawal charge technique.

Dangers and Criticisms of the SWR

Whilst the protected withdrawal charge (SWR) technique is the basis of maximum retirement making plans, it’s no longer with out its dangers and criticisms. Figuring out those is paramount if you need a greater working out of find out how to navigate your retirement. Underneath are a few things to believe when depending at the SWR technique:

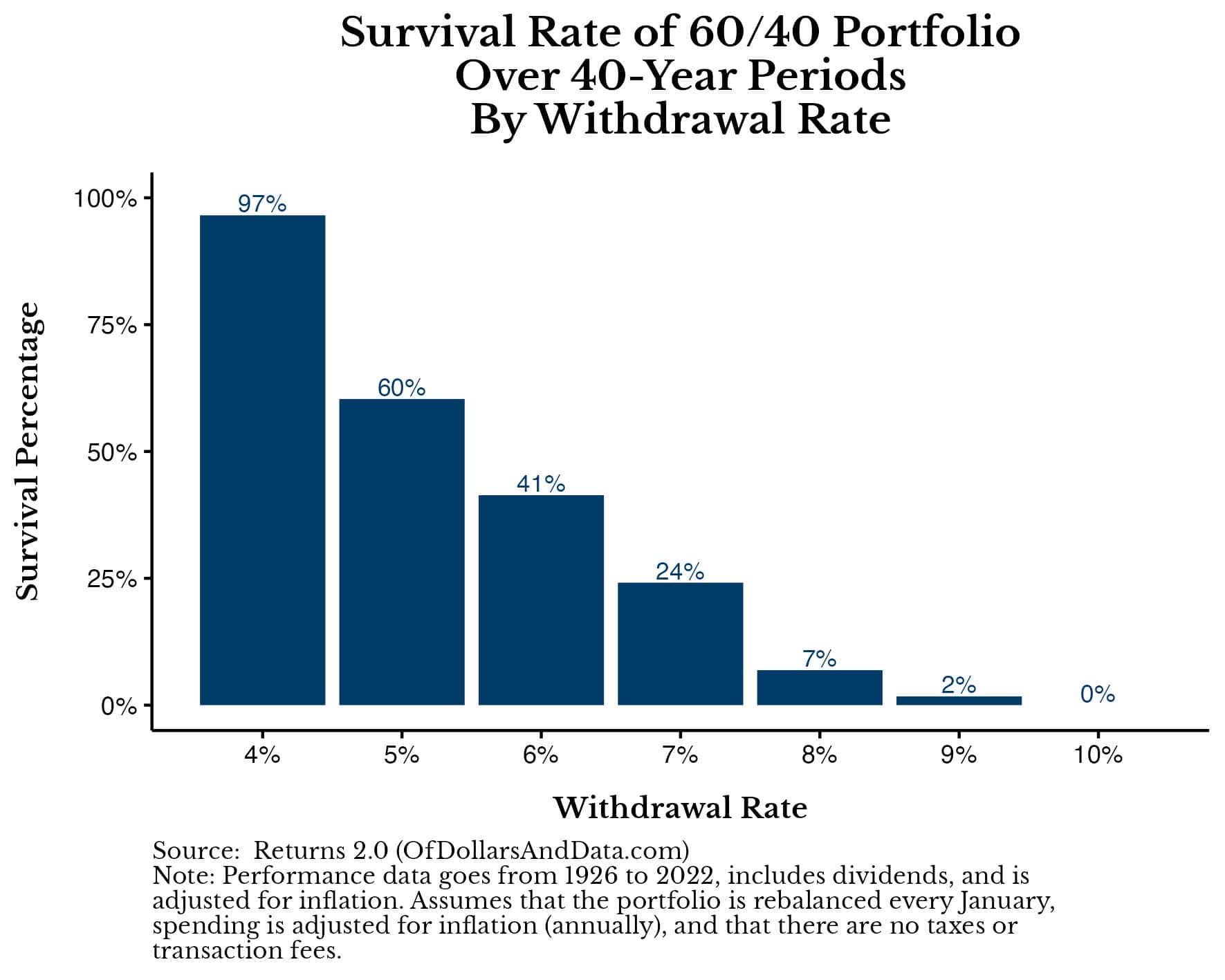

- Longevity Chance: Maximum retirement SWR simulations think a 30-year time horizon. Sadly, when you find yourself residing past 30 years in retirement, your possibility of operating out of cash will increase reasonably. For instance, with a 60/40 portfolio over a 40-year time horizon, the ancient survival likelihood with a 4% withdrawal charge used to be 97% (in comparison to 100% with a 30-year time horizon):

- Inflation Chance and Spending Declines: Along with residing longer, the SWR assumes that you’re going to be capable of simply building up your spending through inflation every year. This is probably not the case right through sessions of upper inflation. Extra importantly, this assumption could also be fallacious altogether. The analysis suggests that spending in retirement has a tendency to decline over the years, through about 1% consistent with yr (on reasonable). This makes logical sense as retirees is probably not prepared or in a position to devour on the identical charge as they did once they have been more youthful. Whether or not that suggests no longer purchasing new garments or no longer with the ability to shuttle (for well being causes), spending may decline right through retirement. Whilst this isn’t true for all retirees in any respect sessions of time, it does illustrate how the yearly inflation adjustment assumed through the SWR technique is probably not life like.

- U.S. Ancient Reliance: Lots of the SWR literature is based totally upon ancient information this is very U.S. targeted. For the reason that U.S. inventory efficiency has been an outlier (relative to maximum different markets) for a very long time, depending in this asset magnificence and its upper than reasonable returns is probably not a wise selection. After all I believe the U.S. shall be tremendous, however no longer 7% consistent with yr annualized tremendous. Whilst I haven’t run the numbers at the SWR for a globally different portfolio, my stoop is that any such portfolio would no longer be capable of maintain the upper withdrawal charges {that a} upper U.S. inventory portfolio may traditionally.

- Spending Inflexibility: My greatest gripe with the SWR is how rigid the spending plan is. You anchor your spending to the primary yr of retirement after which are compelled to modify it with inflation every year. Alternatively, there is not any reason issues wish to be this manner. Now not simplest will your spending alternate (and most likely lower right through issues of your retirement), however the concept we will be able to’t scale back right through exhausting instances or regulate our spending upward or downward turns out fallacious to me.

- Mental Discomfort of Withdrawals: Of all of the issues in this listing, the mental discomfort of retreating cash from a portfolio could also be the article that stops maximum retirees from the usage of protected withdrawal charges. If I needed to wager, this discomfort most likely comes from the truth that other folks don’t like the sensation of no longer making growth. Consider spending 40 years running and saving and gazing your internet value develop to then enjoy the opposite of this in retirement. That is most definitely why maximum retirees don’t drain their major in retirement. As I said in Simply Stay Purchasing:

“Throughout all wealth ranges, 58 p.c of retirees withdraw lower than their investments earn, 26 p.c withdraw as much as the volume the portfolio earns, and 14 p.c are drawing down major.”

If the analysis means that retirees most often don’t drain their major, then there may be most definitely a mental reason why for it. And no matter that reason why is, that’s one of the vital explanation why a SWR is probably not efficient over the long-term for lots of retirees.

Now that we’ve appeared on the dangers and criticisms of the protected withdrawal charge, let’s discover some choice retirement spending methods.

Possible choices to the Protected Withdrawal Fee

If the protected withdrawal charge isn’t best for you, there are every other choices you’ll believe right through your retirement together with: the Guardrail technique, the Versatile Spending technique, and the Are living Off the Passion technique. I will be able to overview each and every of those in flip.

Guardrail Technique

The Guardrail technique is a dynamic strategy to retirement withdrawals. It comes to atmosphere predetermined “guardrails” or thresholds on your general portfolio price. In case your portfolio price exceeds the higher limits, you’ll building up your withdrawals. Alternatively, in case your portfolio drops beneath the decrease limits, you lower your withdrawals.

The volume you building up or lower your withdrawals is as much as you. For instance, Rachael Camp, CFP supplied an instance the place in case your portfolio rises sufficient such that you’re simplest retreating 3% of your portfolio, then you definitely building up your spending through 10%. If it falls sufficient such that you’re retreating 5% of your portfolio, you could lower spending through 10%.

For instance, should you get started with $1 million and are pulling 4% consistent with yr ($40,000), with the Guardrail technique you could stay this consistent till your portfolio reached $1,333,333. At this level, $40,000 would simplest be 3% of your overall, then that you must building up it through 10% to $44,000 transferring ahead. From that time you reset the guardrails and regulate your spending accordingly.

This technique supplies flexibility and responsiveness to marketplace prerequisites, probably extending the longevity of your retirement budget. It’s in particular helpful in managing the mental discomfort related to fastened withdrawals (that I discussed previous), because it adapts to real-time monetary realities.

Versatile Spending Technique

Very similar to the Guardrail technique, the Versatile Spending technique is determined by marketplace situation to regulate spending over the years. It really works through dividing your spending into two classes: required and discretionary. Your desired spending is the spending that you must do annually. It’s fastened and it adjusts every year with inflation.

Alternatively, your discretionary spending contains all of the issues in lifestyles which might be great to have, however no longer vital on your retirement. This would come with great holidays, going out to devour, and/or Taylor Swift live performance tickets. If it feels discretionary to you, then it’s discretionary.

Extra importantly, your discretionary spending is ready at first of your retirement and not adjusts with inflation. Alternatively, it does range in line with marketplace prerequisites, as I detailed on this put up:

On December 31 of each and every yr you take a look at to peer how some distance the S&P 500 is clear of its all-time highs. In response to that quantity, your discretionary spending falls into certainly one of 3 conceivable prerequisites:

- Commonplace marketplace: If the S&P 500 is lower than 10% clear of its highs, you spend all of your discretionary spending within the subsequent yr.

- Correction: If the S&P 500 is greater than 10% clear of its highs however lower than 20% clear of its highs, you spend part of your discretionary spending within the subsequent yr.

- Endure marketplace: If the S&P 500 is greater than 20% clear of its highs, you spend none of your discretionary spending within the subsequent yr.

The disadvantage to this technique is that, in some years, you must scale back to your way of life as a result of you don’t have any discretionary spending. Alternatively, the upside to that is that during different years you’ll spend extra in retirement. Through the usage of the Versatile Spending technique traditionally, that you must’ve survived with a 5.5% withdrawal charge slightly than the 4% withdrawal charge (assuming 50% of your spending used to be discretionary).

Notice that you simply don’t get to spend extra overall cash in retirement when the usage of the Versatile Spending technique (this isn’t a loose lunch), however you do get to spend just a little extra in maximum years.

Are living Off the Passion (aka Fit Spending to Source of revenue)

The most simple retirement spending technique is what I name “Are living Off the Passion” the place you merely are living off of the pastime/dividends that your portfolio can generate. So in case you have a $1 million portfolio that throws off 2% consistent with yr in pastime/dividend source of revenue, then you definitely get to are living off of $20,000 a yr.

The benefit of this technique is that it promises that you’re going to by no means run out cash. Alternatively, the unhealthy factor is that it calls for that you simply save up somewhat just a little more cash to give a boost to your way of life. In a global of five% Treasury Expenses this technique is excellent, but if rates of interest have been close to 0 a couple of years in the past, a retiree would have wanted a miles greater nest egg to get through.

The opposite factor with this technique is that your spending will differ over the years. If there’s a down yr out there and corporate dividends get lower, then so does your retirement spending. Coping with this spending volatility on most sensible of the entire decrease spending quantity (in comparison to a SWR technique) might be traumatic for some.

Bucket Technique

Ultimate, however no longer least, there may be the Bucket technique. This technique works through bucketing your spending into temporary, medium-term, and long-term buckets after which making an investment each and every bucket of cash as such. For instance, cash had to pay for meals and different quick bills might be invested in temporary Treasury expenses or money whilst the ones expenditures that received’t occur till later (i.e. grandchildren, and so on.) may also be invested in shares and different possibility belongings.

For instance, anyone with a $1 million portfolio the usage of a Bucket technique would possibly make investments their cash as such:

- Quick-term bucket: $120,000 in a high-yield financial savings account or temporary Treasury expenses. This covers your residing bills for the primary 3 years.

- Medium-term bucket: $400,000 in a balanced mixture of shares and bonds. This portion is for years 4-10 of your retirement, providing a stability between enlargement and protection.

- Lengthy-term bucket: The remainder $480,000 in different inventory budget or ETFs, aiming for enlargement over the long run.

The speculation in the back of the Bucket technique is to compare your funding technique with the true liabilities you are expecting in retirement. It will come up with extra peace of thoughts than having your entire cash in one account (or bucket).

Despite the fact that your general portfolio allocation could also be the similar between a Bucket technique and an SWR technique, through breaking your cash into other buckets (or accounts), the Bucket technique can come up with an extra layer of mental convenience. And, in spite of everything, what issues extra in retirement than peace of thoughts?

The Backside Line

Without reference to what spending technique making a decision to make use of in retirement, working out the protected withdrawal charge (SWR) and its choices is a very powerful for navigating your golden years with monetary self belief. Whilst the SWR gives a robust basis, it’s no longer for everybody. That is the place methods just like the Guardrail, Versatile Spending, Are living Off the Passion, and the Bucket Technique may also be of use.

So whether or not you adhere to the normal SWR, undertake a dynamic means just like the Versatile Spending technique, or favor the structured simplicity of the Bucket Technique, among the best plan is person who works for you. Retirement is a private adventure, so that you shouldn’t really feel stressed to are living it in a technique or any other.

In the end, what issues is that you simply spend your cash in some way that aligns together with your values, objective, and imaginative and prescient on your retirement. I will’t let you know what this is. However, through moderately making an allowance for those methods (and others), you’ll means your golden years with better peace of thoughts, ready for regardless of the long term holds.

Satisfied making an investment and thanks for studying!

If you happen to favored this put up, believe signing up for my publication or trying out my prior paintings in book shape.

That is put up 376. Any code I’ve associated with this put up may also be discovered right here with the similar numbering: https://github.com/nmaggiulli/of-dollars-and-data